Previous events

This month

How to Build Solid Trust and Rapport in Seconds

The Personal Finance Society Ipswich Committee, in association with the Insurance Institutes, is delighted to present the second of our exclusive 1-hour soft skills training seminars with Bernie De Souza, the UK’s #1 Soft Skills Coach.

View event detailsAll previous events

IF1Dual Revision Session

Are you currently studying the CII Diploma IF1 Insurance, legal, regulatory and would like some extra revision help? Then look no further! This is a two part revision set of revision sessions that will be taking place online on the following dates: Revision Session 1 - 13:00pm-16.00pm 20th November 2025 Revision Session 2 - 13:00pm-16:00pm 27th November 2025 Learners will gain insight into all areas of the IF1 syllabus and build confidence to take their exam, using real-life examples to illustrate the many principles covered in the unit. The session is suitable for any learners with a reasonable level of familiarity with the LM1 textbook, looking to prepare and revise for the exam. By attending this event, delegates will be able to become more confident across the IF1 syllabus. With an interactive blend of revision quizzes, contribution calculation examples and mock exams, Adrian Toomey will provide insight into the key elements of the IF1 syllabus, focusing on specific areas for questions and parts of the textbook that learners often struggle with. Learners should come prepared to participate and engage in a relaxed and supportive environment, building confidence with the subject matter to take on the IF1 exam in the near future. All attendees will also receive an additional bank of mock exams and revision quizzes, designed by Adrian to support preparation towards the IF1 exam. Adrian Toomey runs a specialist insurance training business (Intuition Training), coaching on many different Cert CII, Dip CII and ACII units. He runs training programmes and revision sessions with insurers, brokers, claims specialists and MGAs, from single office firms through to global organisations, supporting hundreds of learners towards successful completion of their CII qualifications. Please note: You are expected to attend both sessions/workshops.

View event details

Vulnerable Insurance Customers

There has been an increased focus upon the needs of vulnerable customers by the FCA in recent years. Regulatory returns now refer to how many customers with a vulnerability have been identified and what actions have been taken to address those vulnerabilities. There are many resources available to those working in our industry to promote understanding of the legal basis of this approach however, most of this workshop cites examples of the consequences of failing to recognise vulnerabilities and how insurers and brokers may have better handled the situation.

View event details

LM1 Dual Revision Session

Are you currently studying the CII Diploma LM1 London market one and would like some extra revision help? Then look no further! This is a two part revision set of revision sessions that will be taking place online on the following dates: Revision Session 1 - 9.15am-12.15pm 20th November 2025 Revision Session 2 - 9.15am-12.15pm 27th November 2025 Learners will gain insight into all areas of the LM1 syllabus and build confidence to take their exam, using real-life examples to illustrate the many principles covered in the unit. The session is suitable for any learners with a reasonable level of familiarity with the LM1 textbook, looking to prepare and revise for the exam. By attending this event, delegates will be able to become more confident across the LM1 syllabus. With an interactive blend of revision quizzes, contribution calculation examples and mock exams, Adrian Toomey will provide insight into the key elements of the LM1 syllabus, focusing on specific areas for questions and parts of the textbook that learners often struggle with. Learners should come prepared to participate and engage in a relaxed and supportive environment, building confidence with the subject matter to take on the LM1 exam in the near future. All attendees will also receive an additional bank of mock exams and revision quizzes, designed by Adrian to support preparation towards the LM1 exam. Adrian Toomey runs a specialist insurance training business (Intuition Training), coaching on many different Cert CII, Dip CII and ACII units. He runs training programmes and revision sessions with insurers, brokers, claims specialists and MGAs, from single office firms through to global organisations, supporting hundreds of learners towards successful completion of their CII qualifications. Please note: You are expected to attend both sessions/workshops.

View event details

Christmas Quiz in aid of Cancer Support Suffolk

🎄 You’re Invited to the Insurance Institute of Ipswich, Suffolk and North Essex Summer Quiz! 🎄 Get ready for an evening of fast-paced fun, fantastic prizes, and tropical vibes! Join us on Wednesday, 26th November from 5:30pm at Bar Twenty One, 11 St Nicholas Street, Ipswich, IP1 1TH for our Summer Quiz Night — hosted by none other than DJ Simon Byrne, bringing you the excitement of SpeedQuizzing! 🧠🎶 What to Expect: Interactive SpeedQuizzing (no pens, no paper — just your phones!) Prizes galore throughout the night A special award for Best Christmas theme Team Name — so bring your creativity! A Christmas outfit for potential bonus points ! 🎄🎄 🍕 What's Included: 2 x Medium Pizzas per team — on us! £5 per person or £25 for a full team of up to 6 Teams can consist of up to 6 people Submit your team name at the time of booking (these will appear on LinkedIn and our website) 🎟️ PLUS: A Fabulous Raffle! We’ll have card readers on hand, but do bring some cash too. All proceeds from the event and raffle will go to our President’s chosen charity, Cancer Support Suffolk — a local organisation dedicated to supporting individuals before, during and after cancer through education, non-clinical therapies, and wellbeing workshops. 📱 Important Info: We’ll be using SpeedQuizzing software for the quiz. If you’re new to it, visit the Summer Quiz event page on our website for a quick overview. 🚨 Please ensure you’ve downloaded the SpeedQuizzing app before attending! 🎟️ Book Now to Secure Your Spot! Spaces are limited and filling fast, so early booking is strongly advised. We look forward to seeing you there!

View event details

Understanding Freight Liability insurance

Join us for this online event. Step into the fast-moving world of freight and logistics with this engaging presentation by Gavin Hasnip, Underwriting Manager at Lonham. Whether you’re interested in understanding about haulage, couriers, logistics professionals, or warehouse operators, this session will demystify the complexities of freight liability insurance and empower you to navigate the risks of modern transport. What’s in Store? • What is Freight Liability Insurance? Discover how this essential cover protects your legal responsibilities for goods in transit, and how it differs from cargo insurance. • Who Needs It? From hauliers to freight forwarders, learn who benefits most and why. • Contract Conditions & Legal Frameworks Unpack industry-standard contracts like RHA, CMR, BIFA, and more. Understand limitations, SDRs, and the importance of contract incorporation. • Time Bars & Notice Periods Get to grips with critical deadlines and notification requirements that can make or break a claim. • Full Value Liability Explore scenarios where you might need to uplift liability to the full value of goods—and the pitfalls to avoid. • Claims in Action Follow the journey of a typical claim, from incident to settlement, and see how subrogation works in practice. • Subcontracting Risks Learn why subcontracting is both a necessity and a risk, and how to manage liability across the supply chain. Packed with real-world examples, practical tips, and lively visuals, this presentation is your ticket to mastering freight liability. Bring your questions and get ready for an interactive session that will leave you better equipped to protect your clients. This CII-accredited event offers 1 hour's CPD.

View event details

Insurable Interest

An in-depth examination of this fundamental principle of insurance. Especially valuable for anyone studying the IF1 or M05 subjects but relevant to all.

View event details

Challenging for Sales and Client Success

For decades B2B organisations in solution selling have focused their sales approach on understanding client needs and building strong relationships. But research in recent years has clearly established that this is no longer enough, and that the very best salespeople go beyond traditional consultative and solution selling to ‘challenge’ their clients in multiple ways. This session introduces the ‘Challenger Sale’ and explores the first key component to the methodology.

View event detailsThe Insurance Market Cycle

This session explores how the insurance market cycle operates, and how the current soft market has evolved, before turning to the implications for both insurers and brokers. Finally, we explore some core strategies for both protecting existing account revenue and winning new business in this environment.

View event details

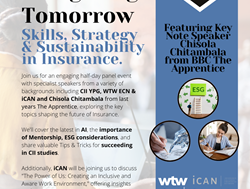

Navigating Tomorrow: Skills, Strategy & Sustainability in Insurance

Join us for an engaging half-day panel event exploring the key topics shaping the future of insurance. We'll cover the latest in AI, the importance of Mentorship, ESG considerations, and share valuable Tips & Tricks for succeeding in CII studies. Additionally, iCAN will be joining us to discuss "The Power of Us: Creating an Inclusive and Aware Work Environment," offering insights on fostering diversity and inclusion within the industry. Below is an overview of the topics that will be explored: The Latest in AI: As AI becomes an integral part of everyday life, often behind the scenes, it's essential for members of all ages to understand its benefits and challenges. This session will explore the pros and cons of AI. Also covering important topics like deepfakes, cybersecurity implications, identity verification, and the environmental impact of AI The Importance of Mentorship: Understand the vital role mentorship plays in professional development within the insurance sector. Gain insights into how mentorship can foster talent, support career growth, and build a stronger, more connected industry community. ESG Considerations: Explore the growing significance of Environmental, Social, and Governance factors in insurance decision-making. Learn how companies are integrating ESG principles into their strategies to promote sustainability, social responsibility, and ethical governance. Tips & Tricks for Succeeding in CII Studies: Receive practical advice and proven strategies to excel in your CII studies. Whether you're just starting or looking to enhance your knowledge, these tips will help you navigate your professional development journey effectively. The Power of Us: Creating an Inclusive and Aware Work Environment," iCAN (Insurance Cultural Awareness Network) are proud to present an inspiring key note and panel event exploring how cultural competency, values, and authentic inclusion can transform workplaces. Following a keynote from Apprentice candidate Chisola Chitambala around Leadership and Cultural Awareness, the panel will bring together leaders and professionals from across the industry to share personal experiences and practical insights on creating environments where everyone feels respected, valued, and empowered to succeed. Through discussion on topics such as adapting communication styles, building relationships across diverse backgrounds, and embedding core ethical values, our speakers will highlight how awareness and empathy can break down barriers and strengthen our industry. Networking Opportunity: After the talks, there will be a chance to connect with fellow attendees, speakers, and industry leaders. This is a great opportunity to share ideas, ask questions, and build meaningful professional relationships. Don’t miss this opportunity to gain valuable insights, practical advice, and inspiration to navigate and influence the future of insurance.

View event details

Impact of U.S. Tariffs on Business Income Loss Measurements

What to expect : 1. Background on Tariffs 1. What is a tariff? 2. Risks and benefits of tariffs, supported by illustrative case studies 2. Current U.S. Tariff Landscape 1. Overview of current U.S. tariffs 2. Review of the impact on insureds based in the U.S. vs. rest of the world 3. Detailed case studies reviewing the impact of tariffs on business income loss measurements 4. Key takeaways for handling/adjusting business income claims for insureds impacted by tariffs

View event details

Thrift and Find Out in aid of Cancer Support Suffolk

We are delighted to invite you to a special evening dedicated to supporting Cancer Support Suffolk. The Thrift and Find Out event offers a wonderful opportunity to make a difference while enjoying a relaxed and social atmosphere. Bring along your pre-loved items to donate in aid of Cancer Support Suffolk, and browse through a curated selection of unique treasures available for purchase. It’s a perfect chance to find something special while supporting a meaningful cause. Enjoy complimentary drinks and nibbles throughout the evening as you connect with fellow members and community supporters. The evening will also feature an inspiring short talk from Kimya of Cancer Support Suffolk, who will share insights into how they provide vital support to those in need. We also will be hearing from Little Lifts. Little Lifts is a charity that provides the most thoughtfully handpicked gift Boxes to people affected by breast cancer. Join us for an evening of community, compassion, and discovery. Your participation can make a real impact—together, we can help support those facing cancer. We look forward to seeing you there! Items that can be donated: 1. Clothing (men’s, women’s, children’s, accessories, shoes) 2. Books (fiction, non-fiction, children’s books) 3. Vintage and retro items 4. Jewellery and accessories 5. Homeware and décor (small decorative items, kitchenware) 6. Toys and games (non-electronic) 7. Handbags and scarves 8. Collectibles and memorabilia 9. Craft supplies and handmade items 10. Small furniture or decorative pieces (if space allows)

View event details

Enabling Womens Careers - Sieze your day for Success!

This session will be live online on Zoom. It will not be recorded as we aim to create a safe space for members to express themselves, network and grow. These sessions are for women and their allies within all levels of PFS and CII. The sessions are facilitated by Caroline who is a Certified Coach and NLP Trainer, however, these sessions are an exploration for all and so please bring your top tips to share with other members of the group and be open to explore and encourage eachother. Please allow up to 90 minutes for this session.

View event details

How to find client objectives that they will care about

Chris Budd will look at the nature of client objectives, and whether they will lead to an increase in client wellbeing. He will discuss how to help clients to understand their own objectives, and the skills advisers need to develop to achieve this. This is a great introduction to the use of simple coaching skills to deliver benefits to your clients and your business, not to mention giving you genuine job satisfaction. Chris Budd is the author of six books, including the original book about financial wellbeing which he wrote in 2015, The Financial Wellbeing Book. The Four Cornerstones of Financial Wellbeing, was published in 2023. He founded the Institute for Financial Wellbeing (IFW) to bring together financial advisers and planners who want to focus on their clients’ happiness, not just their money. Chris lives in Somerset, UK, with his family and too many guitars. Perfect for: Financial advisers, mortgage advisers, and all financial services professionals looking to enhance their client interactions.

View event details

Festival Risk Management and Claims Handling Conference

The Insurance Institute of Ipswich Suffolk & North Essex invites you to join us for our all day Conference on 16th September 2025 As we come to the end of the festival season - from small niche events to the larger scale weekend festivals that attract thousands of visitors across the UK the industry navigates the complexities of this year's events. It's the ideal time to examine what we can learn and how we can better prepare for the 2026 season. What risks are involved and how do we, the Insurance Industry play our part in managing that risk? How does the client start to plan for the event - identifying risks, planning for all eventualities. What happens when things go wrong? What coverage might be available? How do we manage major claims in an ever more litigious society? We have experts from Clients, Brokers, Insurers, Solicitors, and Loss Adjusters ready to help answer these and other questions. Come along for the day and find our more. Refreshments and lunch will be provided. Parking is free to attendees. Speakers are as follows - Katie Moore, Live Nation Tim Rudland, Tysers Karina Gaertner, Azorra Leanne Conisbee, HCR Legal LLP Polly Sayers, HCR Legal LLP Kate Montagu, Miller Hannah Logan, Miller Jon Clarke, Hiscox Claire Welford, Crawford & Company Steven Sawyer, Crawford & Company Brendan Levy, Crawford & Company Courteney Jamison, Crawford & Company Date and Time 16th September 2025 from 9am to 6pm including a cash bar in the last hour for networking. Location - Venue 16 - 312 Tuddenham Road, Ipswich, Suffolk, IP4 3QJ

View event details

YPG - Footgolf for - The insurance Charity

Join Us for a Fun-Filled Footgolf Fundraiser! The CII Young Professionals Group (YPG) is excited to invite you to a fantastic event combining networking, friendly competition, and charitable giving — all set against the beautiful backdrop of Fynn Valley. This unique Footgolf event will support The Insurance Charity, with teams of four taking on a nine-hole course. It’s a great opportunity to connect with fellow professionals while enjoying some light-hearted competition as you aim for the lowest score! Event Details: Location: Fynn Valley, Witnesham, Ipswich, Suffolk, IP6 9JA Format: Teams of four | 9 holes of Footgolf | Networking opportunities Fynn Valley is a stunning venue, offering a relaxed and scenic setting perfect for this summer social. Please also note ball hire is included so no need to bring anything. There is no dress code, but football and rugby boots are not permitted – trainers are perfect! We look forward to seeing you there — bring your A-game and your best networking smile!

View event details

Navigating the Hybrid Work Model

We’re thrilled to present our third webinar with @Mental Health in Business ! On 7th August 2025 at 12-1pm we will be joined by @Jay Unwin. As hybrid work becomes the new normal, join us for a conversation packed with usable strategies to: • Identify common challenges in hybrid work settings • Learn strategies for effective communication and collaboration in hybrid teams • Develop skills for managing time and setting boundaries in flexible work arrangements • Explore techniques for maintaining team culture and connection across diverse work environments Whether you’re a member of a hybrid team or a team leader, this session will offer concrete tools to boost both team wellbeing and productivity. Don’t miss out – secure your spot today and walk away with actionable insights for thriving in the new hybrid work model!

View event details

Gaining a Deeper Understanding of ADHD in the Workplace

Did you know? Adults with ADHD are nearly 60% more likely to be fired, 30% more likely to face chronic employment challenges, and three times more likely to quit a job impulsively. These statistics highlight the urgent need for our workplaces to become more inclusive and supportive of neurodivergent employees. However, research also shows that employees with ADHD often bring exceptional creativity to problem-solving, demonstrate higher levels of entrepreneurial thinking, and can be incredibly productive when working in environments that match their strengths. So, how can we create environments where everyone—regardless of how their brain works—can thrive? Join us at Arlingtons, Ipswich on 31st July 2025 at 5:30 PM for an insightful discussion on ADHD in the workplace. We'll be joined by Rosie Turner from ADHD Untangled, who will share practical strategies to: • Recognise how ADHD and neurodivergence manifest in real-life settings. • Build environments that support neurodivergent clients and team members. • Create spaces where everyone can thrive. This event is open to anyone interested in fostering inclusive workplaces; it is an excellent opportunity to learn, share experiences, and collaborate on strategies to foster inclusive workplaces. Please RSVP using the link below to secure your place.

View event details

Summer Quiz in aid of Cancer Support Suffolk!

🌴 You’re Invited to the Insurance Institute of Ipswich, Suffolk and North Essex Summer Quiz! 🌴 Get ready for an evening of fast-paced fun, fantastic prizes, and tropical vibes! Join us on Wednesday, 23rd July from 5:30pm at Bar Twenty One, 11 St Nicholas Street, Ipswich, IP1 1TH for our Summer Quiz Night — hosted by none other than DJ Simon Byrne, bringing you the excitement of SpeedQuizzing! 🧠🎶 What to Expect: Interactive SpeedQuizzing (no pens, no paper — just your phones!) Prizes galore throughout the night A special award for Best Hawaiian-Themed Team Name — so bring your creativity! Hawaiian shirts are highly encouraged 🌺 🍕 What's Included: 2 x Medium Pizzas per team — on us! £5 per person or £25 for a full team of up to 6 Teams can consist of up to 6 people Submit your team name at the time of booking (these will appear on LinkedIn and our website) 🎟️ PLUS: A Fabulous Raffle! We’ll have card readers on hand, but do bring some cash too. All proceeds from the event and raffle will go to our President’s chosen charity, Cancer Support Suffolk — a local organisation dedicated to supporting individuals before, during and after cancer through education, non-clinical therapies, and wellbeing workshops. 📱 Important Info: We’ll be using SpeedQuizzing software for the quiz. If you’re new to it, visit the Summer Quiz event page on our website for a quick overview. 🚨 Please ensure you’ve downloaded the SpeedQuizzing app before attending! 🎟️ Book Now to Secure Your Spot! Spaces are limited and filling fast, so early booking is strongly advised. We look forward to seeing you there!

View event detailsEnabling Womens Careers - Confidence, Calm and Courage - Thriving beyond your comfort zone

Womens Forum In this workshop we are going to take a dive into Confidence Calm and Courage and exploring what might be holding us back and how we can all thrive beyond our comfort zones. This session will be live online on Zoom. It will not be recorded as we aim to create a safe space for members to express themselves, network and grow. These sessions are for all levels of PFS and CII and future topics will be established from member feedback within the group. The sessions are facilitated by Caroline who is a CII member, Certified Coach and NLP Trainer, however, these sessions are an exploration for all and so please bring your top tips to share with other members of the group and be open to explore and encourage each other. Please allow up to 90 minutes for this session.

View event details